Everything we do adheres to our unique wealth model to ensure you have the best chance of achieving your goals in a secure and sustainable way. Incorporating the four building blocks critical to financial success: educate, protect, grow and enjoy, our approach aims to provide a robust strategy to build your financial plan & success.

Our Advantage

Education - Learn basics to think like an "insider"

You need to know enough to start thinking like an “insider” so you can take ownership of your financial future. You also need this knowledge so you can plan early before opportunities or timing are missed.

Accordingly, one of the core services we offer here is tax and accounting training. We are continuously developing courses to help you learn, which you can book below or under the book online tab.

Protection - You and your assets

This is the foundation of wealth creation so you can grow your wealth responsibly and sustainably.

Strategy

You need clarity about your financial goals and timeline, then developing a strategy to generate passive income to ultimately replace your business or employment income. The strategy needs to be reviewed annually at a minimum, and when there is any major life or economic event, to ensure it continues to deliver what is required.

Structure

It’s important to determine the right structure for your business, investment and retirement in your unique situation. Each of these areas needs to be considered separately so you are set up for optimal protection and efficiency.

Risk management

Your most valuable asset is you, so risk management should start with protecting you and your ability to generate income. In addition, your other assets need to be protected with appropriate insurances and entity structures. These insurances all need to be reviewed regularly to ensure they remain appropriate and you are getting the best deal. Furthermore, structures for asset protection need to be set up before assets are acquired as it can be very costly to restructure at a later date.

Growth - Sound wealth strategy

Investment

The cornerstone of intelligent investment is asset and funds allocation and how you diversify your portfolio. This is to ensure no matter what the market is doing, whether there is inflation or deflation, your portfolio is sound. No one can predict the market so your asset allocation strategy is critical to maximising the upside while minimising the downside. We work closely with reputable financial advisors to assist you make the best financial and informed decisions.

Debt management

Not all debt is created equal. Your debt management strategy ensures debt is held in the right entity for tax deductibility, and it builds in regular reviews to make sure the interest rates and terms are optimal for you. We work closely with reputable banks and mortgage brokers to ensure the best rates and terms are fetched for you.

Enjoyment - Short & Long term rewards

Pre-retirement distribution and cashflow

Investment is about enhancing your life in the immediate term and not just at retirement. A sound wealth strategy helps you enjoy the journey as well as the destination.

Post-retirement distribution and cashflow

Your financial plan works toward building income-producing assets to replace your income when you retire. Most plans build assets and forget about the income part of the equation, but you don’t live on assets, you live on income. Execution of a sound strategy means you never have to worry about your money running out.

One of the biggest challenges people face when managing their finances is trying to coordinate multiple people with different agendas.

Most people work long hours to earn active business and employment income combined with family life and other commitments means planning your financial future isn’t always a priority. This could mean you are missing out on opportunities or making one (or more) of the common financial mistakes. Financial planning and management is complex and requires an all rounded expertise.

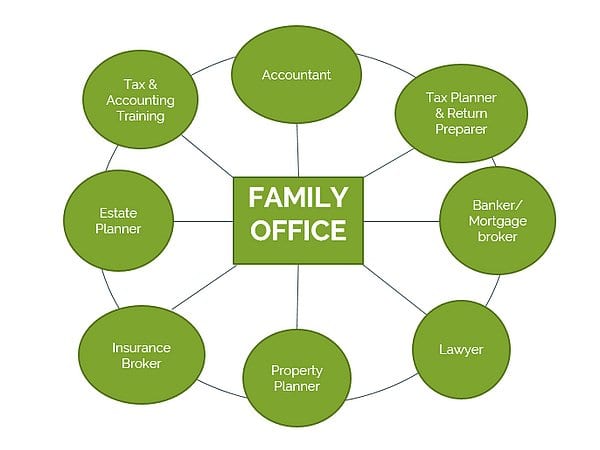

That’s why the ultra-wealthy have what’s called a “family office”, one place to create a financial plan and to coordinate the execution of it. We believe a “family office” should be accessible to everyone. The benefit of this is you mainly have us as your main point of contact. We are well connected with reputable contacts in the legal, banking and insurance industries so can co-ordinate with them when needed.

Here, we help you to learn, think, plan, invest and enjoy like a ultra-wealthy person so you can feel confident and hassle free in your financial situation.

Get started with us now

Book a free consultation

Speak to a member of the team today about how we can assist and schedule a convenient time to have a chat with one of our specialists. We aim to respond within one business day.