Now, we are almost 2 weeks in since level 4 lockdown on 17 August 2021, more businesses (in particular commercial property investors) are certain the level of decrease in revenue qualifies for wage subsidy and/or resurgence support payment.

We outline below the eligibility criteria of these COVID business support, tax treatment for these subsidies, wider government support for businesses and IRD’s use of money interest (UOMI), penalties and other types of relief.

Wage subsidy

For this round, the wage subsidy has changed slightly since it was last used in February. Key things to note are:

- Eligible employers throughout New Zealand can apply for the Wage Subsidy if they expect a loss of 40% of revenue as a result of the Alert Level change. Generally, this is over the period between 17 August 2021 and 31 August 2021 (inclusive) for first round and between 31 August to 13 September (inclusive) for the second round, compared to a typical 14-day consecutive period of revenue in the 6 weeks immediately before the move to Alert Level 4 on 17 August 2021.

- The Wage Subsidy has increased to $600 per week per full time employee and $359 per week per part time employee.

- First round of applications for the Wage Subsidy opened on 20 August with the first payments expected three days following. The second round will open on 3 September at 9am.

- The Wage Subsidy will be paid as a two-week lump sum.

A high trust model will be implemented as before, but note businesses who expect a loss of 40% of revenue, but did not have this eventuate will face pressure to make repayment of the subsidy. In addition, further payments might be available should the heightened alert level remain for longer than two weeks.

Resurgence Support Payment

The Resurgence Support Payment is back for a fourth round. Key things to note are:

- Eligible businesses throughout New Zealand can apply for the Resurgence Support Payment if they incur a loss of 30% of revenue or capital raising ability as a result of the Alert Level change. “Capital raising” includes external funding raised by a pre-revenue business or organisation for the purposes of becoming market-ready; businesses shall keep records of how their ability to raise capital or begin trading was affected by the raised alert level.

- The Resurgence Support Payment continues to be $1,500 plus $400 per full-time equivalent employee, up to a maximum of 50 full-time employees (so a maximum payment of $21,500).

- Income that is received passively, such as interest and dividends, and all forms of residential and commercial rent is excluded from the measurement of revenue.

- Businesses and organisations (including sole traders) must have been in business for at least 6 months, for applications prior to 9 September 2021, or 1 month for applications after 9 September 2021.

There are other eligibility criteria detailed on IRD’s website. You can find them here.

Tax Treatment – Wage Subsidy and Resurgence Support Payment

For income tax purposes, both wage subsidy and resurgence support payments are exempt income, but the corresponding expenditure is non-deductible.

For GST purposes, the wage subsidy is exempt, while the resurgence support payment needs to be included in the GST return.

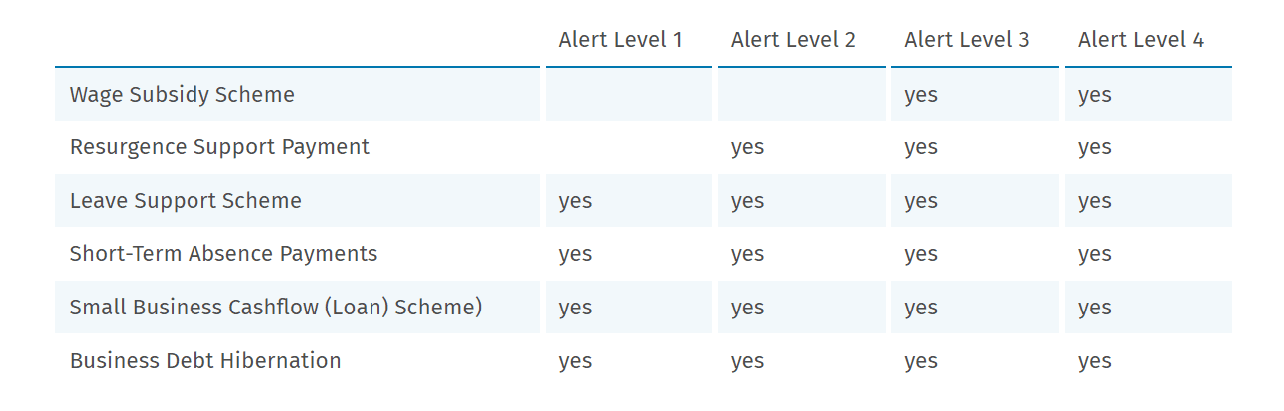

Wider government support

There are a wide range of other support measures available for businesses affected by COVID-19. A summary is in the table below and full details are available here.

Remission of penalties and use of money interest

To be eligible for remittance of penalties and UOMI, the taxpayer must meet the following criteria:

- Tax is due on or after 14 February 2020;

- ability to pay by the due date, either physically or financially, has been significantly affected by COVID-19; and

- contact the Commissioner as soon as practicable to request relief and will also be required to pay the outstanding tax as soon as practicable.

Types of relief available for new tax debt due to COVID-19 are as follow.

- Instalment arrangement

- Instalment arrangement – deferred payment start date

- Partial write-off due to serious hardship and payment of the remaining tax by instalment or a lump sum

- Partial payment and write-off the balance under maximising recovery of outstanding tax

- Write-off due to serious hardship

Need help?

Here, at NZ International Tax & Property Advisors, we are a one-stop Chartered Accountant firm providing international tax, property tax & consulting, accounting and training services to locals, migrants/expats and businesses.

Our A-team has over ten years of experience in Big Four, Mid Tier and boutique Chartered Accountant firms specialising in cross border tax for migrants and expats, taxation on land transactions, IRD disputes and resolutions and small and medium business tax.

If you need assistance now or are interested in our services, we are offering free consultation for new clients to discuss their situation and how we can add value and assist. Visit “Cashflow, reporting and budgeting” and “Income tax, GST, PAYE and FBT return” pages for more information. Follow the link to book a time here.

DISCLAIMER No liability is assumed by NZ International Tax & Property Advisors for any losses suffered by any person relying directly or indirectly upon any article within this website. It is recommended that you consult your advisor before acting on this information.